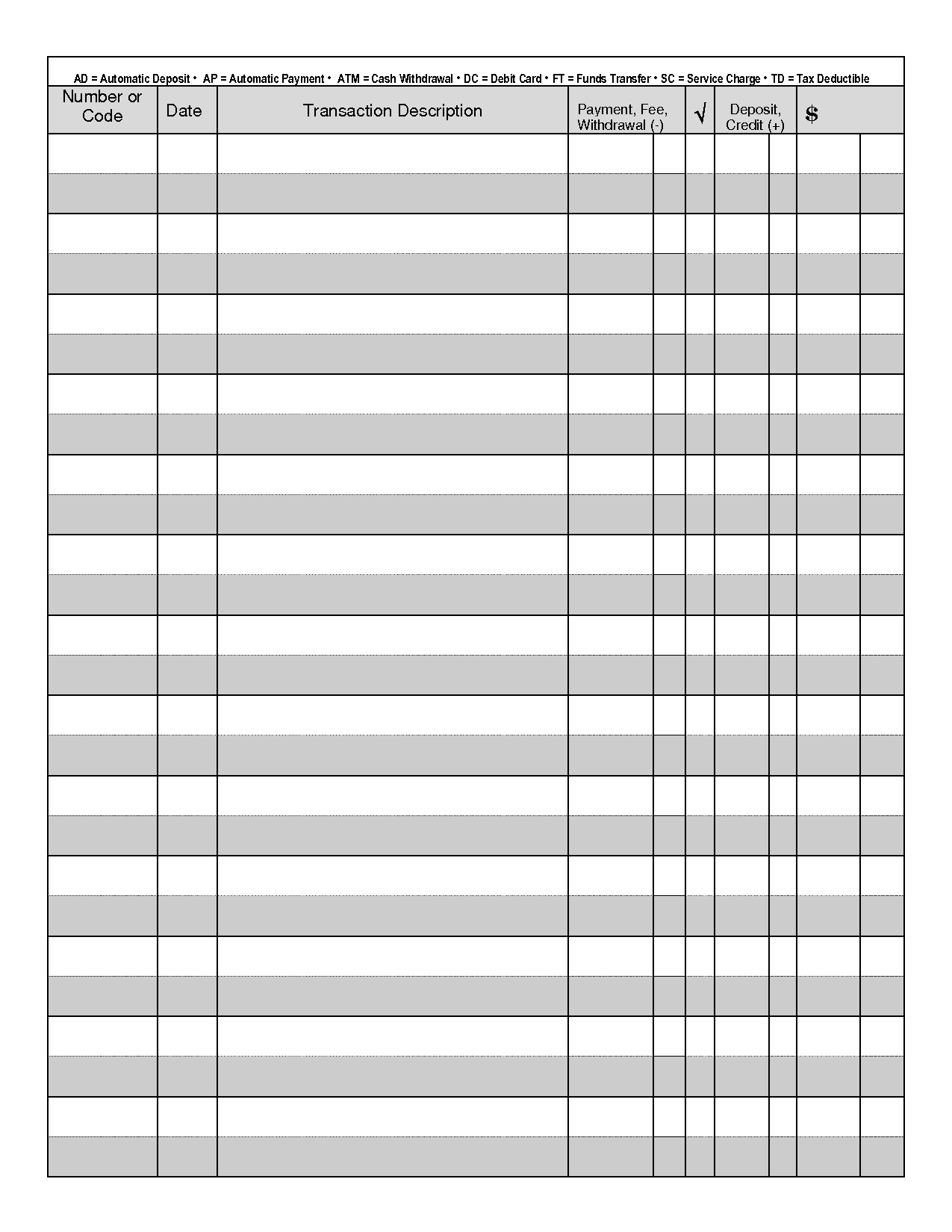

This is also used by the company to check and balance amounts during bank reconciliation processes to be able to identify the issued checks that have not been cleared yet, and those that have been successfully cleared. In here, the payment dates, amounts, names of the payee, and check numbers are included in order for you to record respective financial transactions and keep them up to date, which is a characterization that is inherent to a checkbook register, making it stand out among the other ways of having financial deals accounted for.

0 kommentar(er)

0 kommentar(er)